Installment Of 2019 Property Tax Bill

A reassessment may result in one or more supplemental tax bills being mailed to the property owner. If you send the missing documents they will be processed as Refunds after you have paid both portions of your 2021-22 Property Tax bill.

Some Interesting Features Of Loan Finance Services By Chintamanifinlease Chinta Payday Loans Online Fast Loans Personal Loans

These exemptions reduce the equalized assessed value EAV or taxed value of a home.

Installment of 2019 property tax bill. If you received a tangible personal property tax bill for property you no longer own but you did own on January 1st of the year on the tax bill you are still responsible for paying the tax. 2018 Property Tax Levies and Rates. As a reminder exemption deductions appear on 2021 second installment bills.

Almost all property tax bills are due on receipt. 1st Installment Nov 1 2019 Due Dec 10 2019 2nd Installment Feb 1 2020 Due Apr 10 2020 2018 Income. IRS Tax Tip 2019-134 September 26 2019.

View the Treasurers Office Tax Year 2020 Property Tax Bill Analysis and Statistics ANALYSIS. The Assessors Office administers property tax exemptions that may contribute to lowering your property tax bill. The Tax Roll is prepared and maintained by the County Assessor.

You will need your checking account or creditdebit card information. Or the inclusion of a penalty for failure to comply with certain. May I pay the property tax bill due March 3 2020 before the end of 2019.

The First Installment is an estimated bill equal to 55 of the prior years total tax. If Taxes Were Sold. With scam artists hard at work all year taxpayers should watch for new versions of tax-related scams.

The tax bill charts detail the delinquency date penalty and interest amounts for each type of bill. Paying First Installment Property Taxes Early. Pacific Time on the delinquency date.

The City of Philadelphia offers a number of abatement and exemption programs that may reduce a propertys real estate tax bill. For example the median real estate tax paid on a home in Marin County California rose 9 from 2018 to 2019 to 8103 according to US. The allowance of an exemption that was previously omitted.

Lottery Gaming Credit. You can make online payments 24 hours a day 7 days a week until 1159 pm. If you have not received a tax statement by January 31st please contact the Treasurers Office at 970 474-3473 so that a duplicate statement may be requested.

Reduced user fees for certain installment agreements. If you did not own the tangible personal property on or after January 1 st of the year on the tax bill you need to contact the Property Appraiser immediately at 850606-6200 or LEONPAORG. Tax abatements reduce taxes by applying credits to the amount of tax due.

Exemptions appear on your second installment tax bill. Here are some details about the property lien scam that will help taxpayers. Apply for a property tax exemption.

Tax Year 2020. One such scam involves fake property liens. The final deadline for the second installment of 2019-20 Secured Property Tax is April 10 2020.

The due date for Tax Year 2019 Second Installment was Monday August 3 2020. A bill that replaces the Annual Secured Property Tax Bill due to the following reasons. 2019 Property Tax Levies and Rates.

Did you receive your lottery and gaming credit. Tax exemptions provide tax relief by reducing a propertys assessed value. The supplemental roll provides a mechanism for placing property subject to Proposition 13 reappraisals due to change in ownership or completed new construction into immediate effect.

There are some investors who buy tax-delinquent real properties and participate in auctions held by LGU. FAILURE TO RECEIVE A PROPERTY TAX STATEMENT DOES NOT EXEMPT THE TAXPAYER FROM TIMELY PAYMENT OF THE TAXES DUE. A change or correction to the assessed value of the property.

It threatens taxpayers with a tax bill from a fictional government agency. The easiest and fastest way to pay your Cook County Property Tax Bill is online. To qualify for the credit your primary residence must be in Wisconsin and be owner occupied on January 1 of the.

If you do not have a lotterygaming credit on your tax bill you may still be eligible. Real Property Tax RPT is a tax that owners of real property need to pay every year so that the local government unit LGU will not auction off their property. Tax rules can lock owners in.

Pay your current year Unsecured Personal Property Tax payments online by electronic check eCheck or major credit and debit cards. The last day to pay the Tax Year 2019 Second Installment before late-payment interest charges was Thursday October 1 2020. If your supplemental tax bill is not paid by June 30 after which the second installment became delinquent the.

The Treasurers Office began accepting early payment of the First Installment bill on Tuesday December 3 2019. Search 72 million in available property tax refunds. Regardless of the reason if you do not receive a tax bill by November 10th print a copy online or.

The correction of a Direct Assessment placed on the property from a municipality or special district. Property tax due dates and delinquency dates are established by the state and cannot be adjusted by counties. Beginning January 1 2019 the user fee is 10 for installment agreements reinstated or restructured through an.

The supplemental tax bills is are in addition to your annual property tax bill. The same laws apply as for unpaid annual tax bills. The Tax Code addresses 33 types of property tax bills that vary by delinquency date or by the requirements for applying delinquent penalty and interest charges.

Certain property tax exemptions or credits including the Senior Citizen Homeowners Exemption SCHE Disabled Homeowners Exemption DHE and certain veterans exemptions may result in the removal of. Frequently a new property owners regular tax bill is sent to the previous owner because the Tax Collectors Office is unaware the property has been sold. Changes in ownership or completed new construction are referred to as supplemental events and result in supplemental tax bills that are in addition to the annual property tax bill.

In this post Ill discuss what else you need to know about real property tax.

Experiencing Difficulties In Paying Your Tax

Revolving Credit Vs Installment Credit What S The Difference Personal Line Of Credit Personal Loans Line Of Credit

2021 Singapore Property Tax Guide Rates Calculations And More Propertyguru Singapore

Structure Of Itr 3 Form And Different Ways To File Itr 3 Form Https Www Mastersindia Co Blog Itr 3 Form Income Tax Return Online Masters Income Statement

![]()

How To Calculate And Pay Property Tax In Singapore Privatehome

Iras Rental Income And Expenses

Financial Agreement Form Sample Forms Financial Personal Financial Statement Contract Template

The Most Well Funded Tech Startup In Every Us State Https T Co Wqnvosmnl0 Https T Co J8coctc7aq Tech Startups Start Up Venture Capital

Pin By Caonweb Seo On Caonweb Trademark Registration What Is A Trademark Public Limited Company

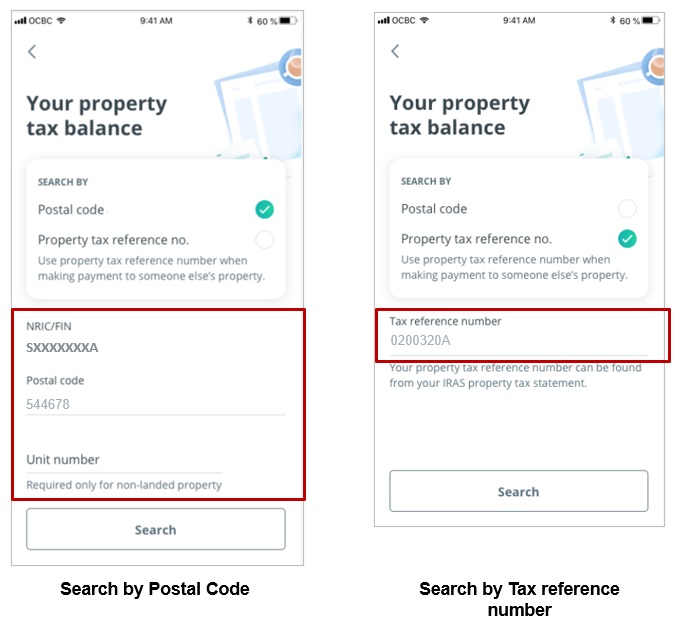

Ocbc First Iras Digital Directpay Tax

Asset Management Vs Property Management For Second Homes Vrm Intel Rental Property Management Property Management Marketing Property Management

Money Matters Shutha Monthly Expenses Expense Sheet Monthly Expense Sheet

Tax Season 2021 About Your Tax Bill

Real Estate Offer Letter Best Of How To Craft An Irrefutable Real Estate Fer Letter Letter Templates Printable Letter Templates Lettering

Personal Financial Statement Personal Financial Statement Financial Statement Statement Template

Tax Season 2021 About Your Tax Bill

List Your Assets Vs Liabilities To Calculate Net Worth Word Problem Worksheets Personal Financial Statement Solving Linear Equations

8 Tips To Spot A Potential Investment Property Investment Property Real Estate Investing Rental Property Real Estate

The Incredible Tax Benefits Of Real Estate Investing Real Estate Investing Real Estate Investing Rental Property Real Estate