Stock Split Vs Stock Consolidation

Share split and share consolidation are regulated corporate actions conducted by companies to increase or reduce the number of shares traded on the stock exchange. More Learn about Shares Outstanding.

Keuntungan Stock Split Bagi Emiten Dan Investor Sikapi

In this video you will knowWhat is a Stock SplitBenefits of Stock SplitPros and Cons of Stock SplitWhy company announces stock splitReasons for stock sp.

Stock split vs stock consolidation. Of shares is called Reverse Stock Split. Generally a stock split takes place if a companys outstanding shares are divided into a larger number of shares without changing the total market value of the companys holdings. Whereas a stock split is viewed by investors as a bullish signal a share consolidation is very much a bearish signal and an indication that the share price could be set to fall further.

One FTSE Snowball Stock With Runaway Revenues. For instance a 5 to 1 reverse stock split of shares of a given class will result in the corporation replacing each block of 5. It might have been consolidated.

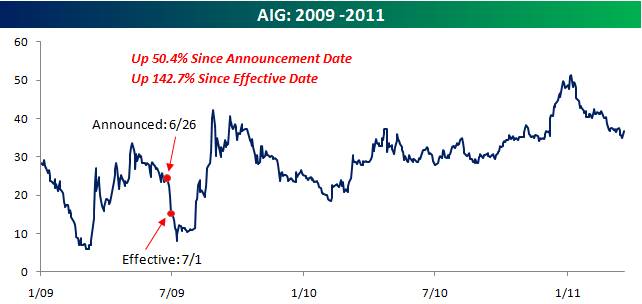

Of shares in the market and the value of shares. Stocks splits have information contain because the activities give the investor signaling effect to the market. Some researches find stock split will increase the stock price around the announcement date.

A stock split is when a company divides the existing shares of its stock into multiple new shares to boost the stocks liquidity. Management of a business can benefit in several ways from a share consolidation. When a stock buyout takes place the acquiring corporation creates more shares of its corporate stock with which to buy out the chosen.

Share consolidation is a corporate action conducted by the company with the intention to reduce its number of shares trading on the stock exchange. The process involves a company reducing the total number of its outstanding shares in the open market and often signals a company in distress. McGuinness1 Abstract Stock consolidations or reverse splits often occur during bear market periods as a means of elevating the value of lowly priced stocks.

In the US it is also known as Reverse Split. However a consolidation may be necessary to. Consolidations are likely to be viewed more negatively by investors than stock splits as strategy consolidations are often linked with companies whose stock price is low because they are facing challenges.

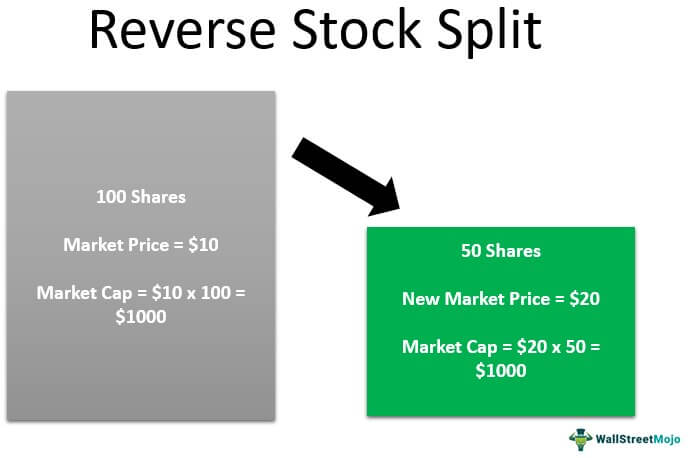

Both share consolidation and share split exercises are subject to shareholders approval in the form of a special resolution at a general meeting under Section 84 1 of Company Act 2016. The number of outstanding shares of a class is reduced by a fraction without altering the equity capital of the corporation. According to Investopedia a reverse stock split is type of corporate action which consolidates the number of existing shares of stock into fewer proportionally more valuable shares.

Splitting one of Alphabets share classes could draw a clearer distinction between the two. Reverse Stock Splits. Company conduct the stock split when the stock price increase but in the other hand reverse stock split conduct when the stock price decreasing.

From 2015-2019 this UK company saw its revenues increase 386 its net income go up 197x and since 2012 revenues from regular users have. A stocks price is also affected by this split and increases the price. The stock split which increases the no.

The total market value of each investors holdings and their proportionate equity in the company are also not affected. With reverse stock splits the corporation simply decreases the quantity of shares of its own stock available in order to increase the price per share. Most investors are familiar with a stock split in which a company issues additional shares to existing shareholders and the price per share is reduced proportionately.

Stock splits and consolidations. Alphabet has only done one stock split in its time as a publicly traded company and it wasnt a typical. The stock split is performed by the company for increasing or decreasing the no.

A reverse split is the opposite transaction and reduces the number of outstanding shares and pushes the stock price higher. In a share split a company. These share consolidations can take place either in the forms of reverse stock splits or as stock share funded buyouts.

What Is A Share Consolidation. Preliminary Evidence for Hong Kong By Paul B. 24 Under the call-in method the Listed Issuer implements the stock split by replacing the share certificates currently in the hands of the shareholders with new certificates.

It does so by reducing the number of shares held by its existing shareholders. Less well known are reverse stock splits also known as share consolidations. The Impact of Stock Consolidations and Capital Reductions on Equity Valuation.

The action of a reverse split allows existing. Siyata MobileSIMV recently did this and the price change went up by 8000. September 2017 Policy 9 Name Change Stock Splits and Share Consolidation 2 Date are provided with additional share certificates by the Listed Issuer.

Of shares is called as forwarding Stock Split and stock split which decreases the no. For a share split the number of shares that you own are increased and for a reverse share split or consolidation the number of shares that you own are decreased however the total value of your shareholding remains constant. Traders who agree with this conclusion may choose to use Contracts For Difference CFDs to short sell a companys shares once a share consolidation has been announced.

A reverse stock split or share consolidation is the mirror transaction of a forward split. They did a 1-to-145 split and cut the number of outstanding shares. A reverse stock split is also known as a stock consolidation stock merge or share rollback and is the opposite of a stock split where a share is divided split into multiple parts.

What Happens To Options While Stock Is Doing Reverse Split Reinis Fischer

67 Off Kenneth Cole New York Men S Stock Split Oxford

/stock-market-data-with-uptrend-vector-183766131-ca2f390eb868433c958f05565bcb23da.jpg)

Why Some Companies Don T Split Their Stock

Stock Splits Explained Youtube

Google Stock Split History The Most Controversial Stock Split Ever The Motley Fool

Stock Dividend Vs Stock Split Top 6 Best Differences With Infographics

What Is A Stock Split Robinhood

Big Alpha Pengertian Stock Split Dan Manfaatnya

Reverse Stock Splits Good Or Bad For Shareholders Cabot Wealth Network

Sudah Tahu Istilah Stock Split Dalam Dunia Saham Akseleran Blog

Reverse Stock Split Definition Examples List Of Companies

Stock Split Meaning History Formula Advantages Reasons

Stock Splits Explained Youtube

Reverse Stock Split Meaning Example How It Works

Reverse Stock Splits Good Or Bad For Shareholders Cabot Wealth Network

What Happens In A Reverse Stock Split If You Don T Have Enough Shares Quora

Reverse Stock Split Meaning Example How It Works

Apple Stock Split 2020 What You Need To Know Ig Au

Stock Split Watch Is Target Next The Motley Fool