Stock Split With Fractional Shares

For example clients that. For example stock splits may result in fractional shares if an investor has an odd number of stocks.

What Are Fractional Shares Get Baraka

Only the stock price would effect the ETFs holdings value not number of shares.

Stock split with fractional shares. Fractional shares often result from stock splits which dont always result in an even number of shares. Mergers or acquisitions create fractional shares as companies combine new common stock using a predetermined ratio. For example if a stock split results in 21 shares worth 10 per share youll receive 2 shares and 1 the cash equivalent of 01 shares.

Some custodians sell fractional shares often resulting in capital gains and then split the stock. Any fractional share resulting from such aggregation of common stock upon the reverse stock split will be rounded up and converted to the nearest whole share of common stock. Stock splits which happen when a company reduces its stock price but increases the number of shares you have to make up for it wont affect your fractional shares any differently from if.

But how your broker deals with those fractional shares may differ. For market hours on holidays check the NYSE calendar. A stock split may end up splitting an individual share if an investor owns an odd number of shares.

You have the option to buy shares in up to 30 top US. Currently that fraction of a share is worth 150. Fractional shares often result from stock splits which dont always result in an even number of shares.

A forward split grows the number of shares available while inducing no actual change in the total value of an issuer or investors position. If your broker offers fractional share investing you may simply receive the appropriate amount of fractional shares. Lets use an example.

So if you owned 15 shares you would now have 22 ½ shares. Stock Splits When a forward stock split occurs the number of shares held by shareholders known as outstanding shares increases while the price per share typically decreases. Or your broker may give you the cash equivalent of any non-whole share.

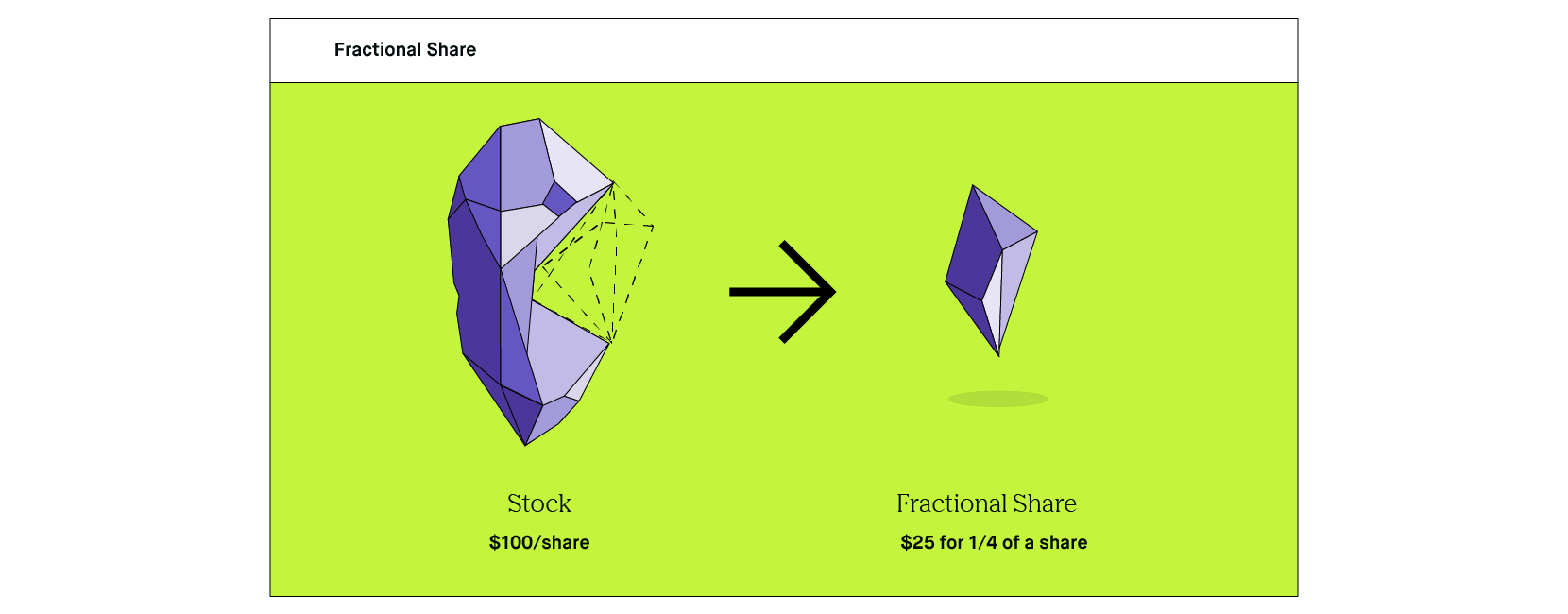

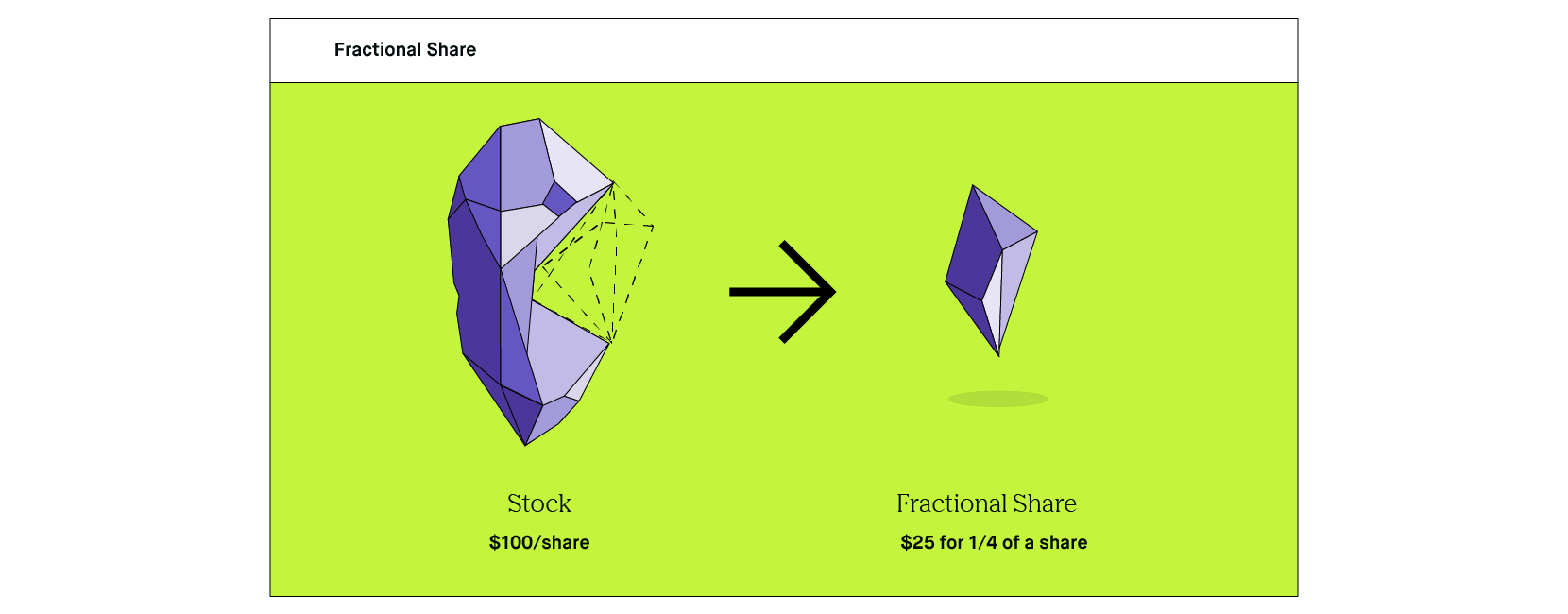

Other custodians simply split the stock and dont do any fractional selling. When you submit your certificates representing the pre-reverse stock split shares of common stock the post-reverse stock split shares of common stock will be held electronically in book-entry form. A fractional share is a portion of an equity stock that is less than one full share.

A stock split simply converts one share of a company into a specified number of shares. A forward stock split proportionally affects both whole and partial shares. The stocks you purchase through Schwab Stock Slices will be individual stocks in your account that you can hold and sell independently.

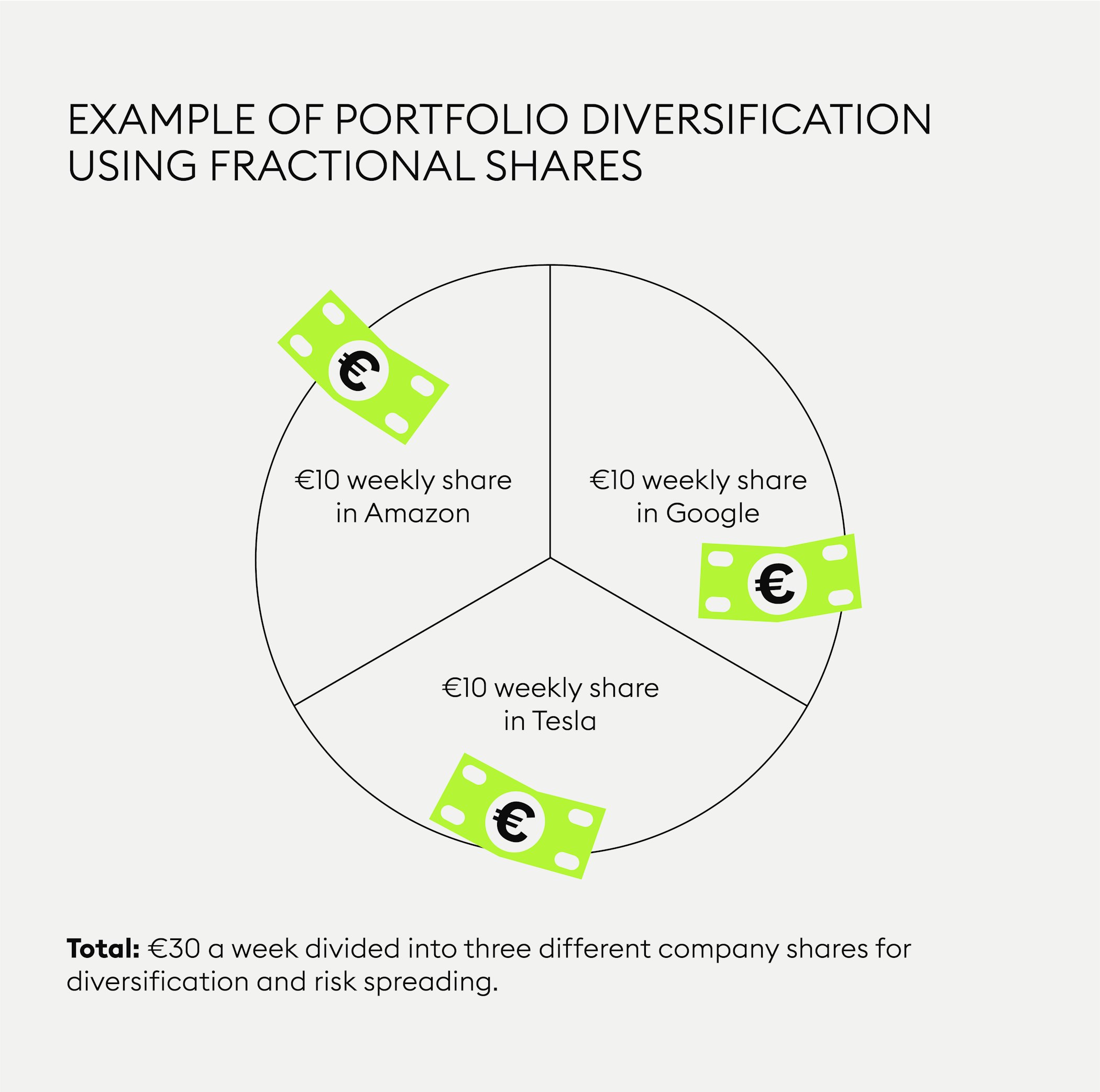

Companies in a single transaction. In the case of Apples announcement a 41 or 4 to 1 Stock Split a shareholder will receive 4 shares for every 1 share they hold. Fractional Shares Then theres the whole idea of Fractional Shares - the purchase of less than one whole share.

Fractional shares and stock splits. Stock splits often result in fractional shares for investors. Custodians handle fractional shares differently during stock splits.

In a 32 stock split for example you receive three shares for every two shares you own. A fractional share is a share of equity that is less than one full share which may occur as a result of stock splits mergers or acquisitions. Stock split shares of common stock for a statement of holding and if applicable a cash payment in lieu of any fractional shares.

But I could be wrong. Do fractional shares pay dividends. Think of a stock spilt like this.

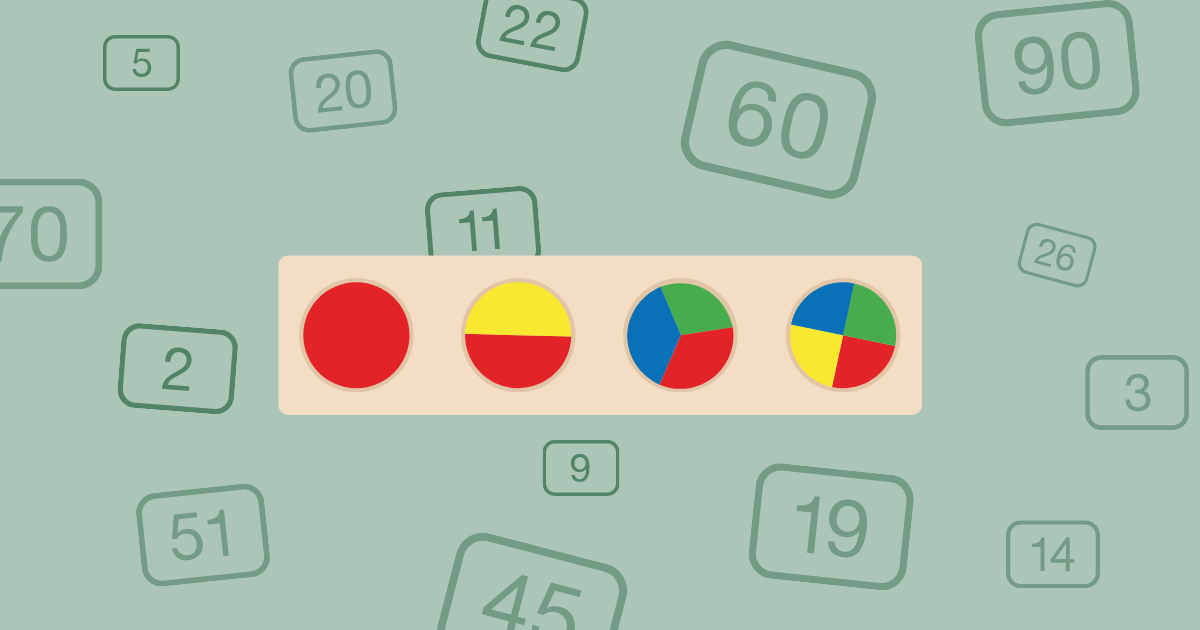

Until recently fractional shares were only created by stock splits and dividend reinvestment plans but they are now offered by some brokers to trade. A fractional share is a part of one share of stockFractional shares are often the result of financial decisions or actions by a company. Split it four quarters for it you still have a dollars worth of money.

For example if you own 10 shares of ABC valued at 10 each and ABC executes a 10 for 1 101 stock split youll now own 100 shares valued at 1 each. Fractional share orders can be placed anytime. Do stock splits result in fractional shares.

That extra half stock is a fractional share. If two companies merge they often combine stocks using an agreed upon ratio that may generate fractional shares. What about Fractional Shares.

Capital gains dollar-cost averaging and dividend reinvestment plans often leave the investor with fractional shares. If you have a 1 bill and I trade you ie. Click here Whats a fractional share.

If two companies merge they may combine stocks with each other using a specific ratio that splits shares into fractions. Other than as a result of the rounding of fractional shares the reverse stock split will affect all stockholders uniformly and will not alter any stockholders percentage interest in the companys equity. Since your ETF wont do any.

For every six shares there will now be one share. Mergers or acquisitions create fractional shares as companies combine new common stock using a predetermined ratio. Youll need one that lets you invest in fractional shares.

After a stock split you would have 05 of a share that is still worth 150. Say a company undergoes a reverse stock split with a ratio of 1 to 6. Fractional share and dollar-based orders are eligible for real-time execution during market hours approximately 930 am to 400 pm ET on normal trading days.

More often than not fractional shares are created after a company engages in a stock split or merges with another company. How to invest in fractional shares. Fortunately Charles Schwab the custodian for most of our client assets will not be selling fractional shares of Apple on the split date.

Schwab Stock Slices is an easy way to buy fractional shares for a set dollar amount. If a stock experiences a reverse stock split youll receive the cash equivalent of any fractional non-whole share amounts resulting from the split in lieu of shares. Find a stock broker.

Fractional shares represent a portion of an equity that is less than a full share. With fractional shares you can still split your available funds between a range of different companies and diversify your portfolio like any other investor just on a significantly smaller scale. A reverse stock split affects the total number of shares first by combining shares then by adding a few new ones when rounding up fractional shares.

Dollar-based orders may only be placed while the market is open.

What Are Fractional Shares Bitpanda Academy

Fidelity Has Fractional Shares With No Trading Windows And Can Set Limit Orders I Want To Switch The Reason I Haven T Is That I Own 70 Stocks And Fidelity Doesn T Have Auto Invest

What Are Fractional Shares Ultimate Guide 2021 Kuberverse

Lesson 2 Stock Splits Fractional Shares Youtube

Fidelity Rolls Out Fractional Shares R Wallstreetbets

Fractional Share Berinvestasi Saham Seharga Es Kopi Susu By Dimas Maulana Medium

What Are Fractional Shares Sofi

What Are Fractional Shares Fractional Share Investing Winvesta

What Happens To Fractional Shares In A Stock Split

What Is A Fractional Share Robinhood

What Are Fractional Shares Fractional Share Investing Winvesta

Fractional Shares Definition What Are Fractional Shares Forbes Advisor

Fractional Share Overview How It Forms How To Trade

Facts You Need To Know Before You Buy Fractional Shares

Fractional Shares Understanding The Smaller Portion Of Investments

Fractional Shares How They Work And How To Invest

What Is A Fractional Share Robinhood

Fractional Share Investing How And Where To Buy Fractional Shares

Fractional Share Definition How Does It Work Benefits Limitations