When Installment Paid The Account Is Debited

Refunds are available after financial aid has paid to the student account the week classes begin. Plus earn an additional 30000 Membership Rewards points if you apply for a Kabbage Funding line of credit get approved and successfully draw at least once on your Kabbage Funding line of credit during the first 3.

What Is A Debit And Credit In Accounting Kashoo

However while having a broad credit mix may not entirely compensate adding an installment loan such as a car loan or a mortgage to your credit mix may help you improve your overall.

When installment paid the account is debited. A financial transaction is an agreement or communication carried out between a buyer and a seller to exchange an asset for payment. The PayPal Commerce Platform is a limited-release solution aimed at partners crowd funding and multi-party commerce platforms. Get Installment Loans Up to 1200 in your bank account as soon as then next business day in 3 easy and quick steps.

The installment amount as shown on the tax bill is the amount due by the party determined at the close of escrow. These options are available using Paygov and are convenient safe and secure and available 247. At MaxLend loan payments are set up to occur on your paydays and new customers typically have 9 months to pay back the loan.

Partners can use the Orders API to create show details for authorize and capture payment for ordersOrders API integration note. I understand that upon completion of the sign-up form my account will be debited immediately for the 1st subscription. Your account will be debited for any amount available in your account plus an ADA Fee.

I amounts actually paid or to be paid by the lender for registration certificate of title or license fees if not included in a. Simply select Direct Debit as your payment method once youve filled in your licence details. Provided interest is paid by account payee cheque to resident individual or HUF.

You can calculate the personal loan EMI using the loan amount the repayment tenure and the interest payable on the loan. Any installment payment of estimated tax exceeds 15000 or. Revolving loan account defined.

Use your bank account and routing numbers to have payment directly debited from your account. As a result installment plan enrollees will pay in 3 installments. You can earn 90000 Membership Rewards points after you spend 10000 on eligible purchases with the Business Gold Card within the first 3 months.

Direct Pay is a free IRS service that lets you make tax payments online directly from your bank account to the IRS. Interest of 210271 assumes a 10000 charge and installment payments of 50429 for 24 months. If your business account has a sole signatory you can set up a Direct Debit online.

Your payments will be automatically debited each month from your designated checking or savings account. Penalty and interest for late filed electronic payments is applicable and will be assessed if not paid with the transmission. If more than the installment amount due is paid.

The date on which a loan or installment payment is. Direct Pay lets you pay the IRS directly. 1962 Code Section 8-800237.

To use Orders API for Partners see PayPal Commerce Platform for Platforms. I authorize the bank to debit my account for the XclusivePlus subscription based on my selected payment plan and preferred date. The check will not be debited from the payers account.

Installment payments calculated with 18 APR and 24-month term accounting for interest accrued between the charge date and the due date 51 days later. If amount of interest paid during the financial year does not exceed Rs. I The initial escrow account statement shall include the amount of the borrowers monthly mortgage payment and the portion of the monthly payment going into the escrow account and shall itemize the estimated taxes insurance premiums and other charges that the servicer reasonably anticipates to be paid from the escrow account during the escrow account.

Your account is debited for the amount you owe until the loan is paid off. For example a new customer with a 9-month loan who gets paid once a month would have a loan with 9 payments and a new customer who gets paid twice a month or every two weeks would have 18 payments. And ii additional charges permitted by this chapter Section 37-3-202.

The approved Automatic Installment amount must not exceed the available credit limit of the. EMI P R 1R N 1R N-1 In the formula P is the loan amount R is the monthly interest rate and N is the repayment tenure in months. You can pay the user fees listed below electronically.

Should be received by the Bank before the purchase andor transaction is reflected in your monthly Statement of Account. Account numbers beginning with the letter F will have a new payment address effective May 1 2019. Most banks charge a fee for this service.

Interest will not be assessed on the deferred amounts as long as the installment payments and subsequent quarter tax payments are made by the. Payment options include Automated Clearing House ACH in which your payment is debited from your checking or savings account or debitcredit card. The payment will be debited via electronic payment from the checking account.

It involves a change in the status of the finances of two or more businesses or individuals. See related question about Stop. If the account has more than one signatory youll need to apply by post.

The Treasurer-Tax Collector cannot adjust the taxes. Tax payments and various amounts credited or debited to your account voluntary contributions. V1 of the API will be deprecated soon.

No TDS from interest paid on 8 Saving Taxable Bonds 2003 or 775 Savings Taxable Bonds 2018 applicable from AY 2019-20 to resident persons. The 110 net 30 calculation is a way of providing cash discounts on purchases which means that if the bill is paid within 10 days there is a 1 discount. For bills not paid in full.

The BANK reserves the right to close the account at any time without prior notice to the Depositor if the account is in the BANKs opinion not maintained in a satisfactory manner when the account is being used as a tool for the commission of fraud or any other crime or when the continued existence of the account with the BANK would prejudice its interest in any way. Download a PDF form at. The buyer and seller are separate entities or objects often involving the exchange of items of value such as information goods services and money.

Personal loans are classed as installment credit whereas credit cards are classified as revolving credit. Subsequent due dates coincide with the 3rd and 4th installment due dates as. Mobile Banking Login to Mobile Banking and select the deposit option select open RD Fill in the required account and nominee details On confirmation the selected amount will be debited from your savings account and your RD account will be instantly created After the RD account is created Recurring Fixed Deposit Advice will be mailed to your registered e-mail ID.

The formula for calculating the personal loan EMI is as follows. Refer to our tip sheet for which option to select in. Using these two types of credit can help you enhance your total credit score.

The first 14000 in wages paid to each employee in calendar year 2013 and. It is not a way to get a direct deposit of your tax refund to your bank account. Check your title papers to see if you were credited or debited an amount for the time in.

A percentage rate reflecting the total amount of interest paid on a deposit account based on the interest rate and the frequency of compounding for a.

Direct Debit Vs Auto Debit What S The Difference Curlec

What Is A Debit And Credit In Accounting Kashoo

How To Use Debit Card For Installments Pay Later Shopping Blog Atome

Business Partnership Agreement Template Inspirational 10 Marketing Partnership Agreement Template Memo Template Agreement Statement Template

Good News To Our Clients With Bpi Accounts After Much Waiting We Are Very Proud To Announce That Automatic Debit Ada Is Now W Debit Keep Calm Artwork Easy

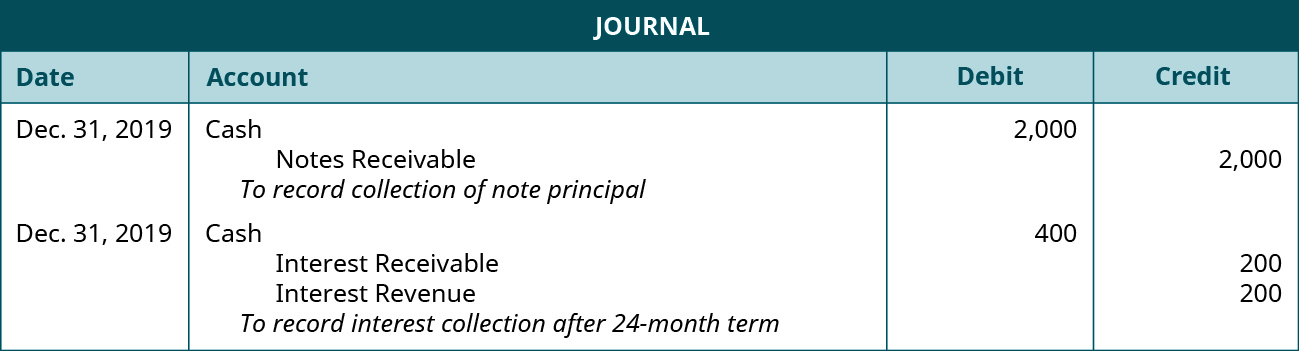

Explain How Notes Receivable And Accounts Receivable Differ Principles Of Accounting Volume 1 Financial Accounting

What Is A Debit And Credit In Accounting Kashoo

Debit Vs Credit Rules In Accounting Difference Between Debit And Credit

What Is A Debit And Credit In Accounting Kashoo

Debits And Credits Chart Double Entry Bookkeeping

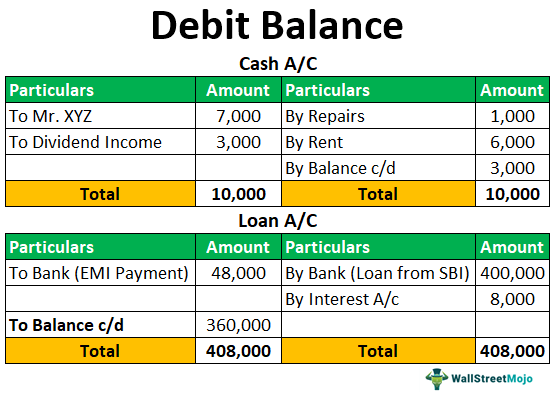

Debit Balance Meaning Example Difference Between Debit And Credit Balance

Accounting Basics Purchase Of Assets Accountingcoach

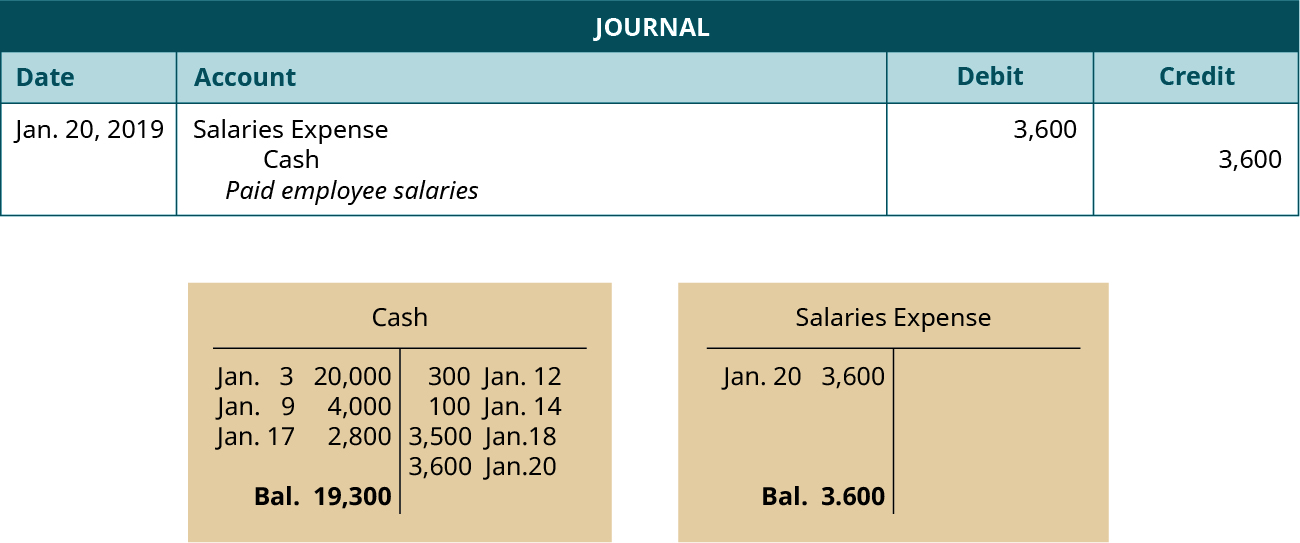

Use Journal Entries To Record Transactions And Post To T Accounts Principles Of Accounting Volume 1 Financial Accounting

Citibank Debit Card Apply Debit Card Online Citibank Singapore

Stripe A Guide To Payment Methods

What Is A Debit And Credit In Accounting Kashoo

Insurance Journal Entry For Different Types Of Insurance

/debit-card-80486969-57102de25f9b588cc27b8924.jpg)