Why Palm Oil Price Drop

The higher crude palm oil prices also lead to greater fertilisation deployment which will ultimately aid in production. The same could be said for Central Market Kaduna as checks revealed that a 25 litres keg of palm oil that was previously sold for between N11200 and N12000 fell to N10500 a 7 or 12 percent decrease.

Questions And Answers About Palm Oil Rainforest Rescue

And consumers benefit in general from lower oil prices and the resulting decline in gas prices at the pump especially in the United States where retail markets react more directly to.

Why palm oil price drop. While Fry expects crude palm oil prices to fall about 20 percent by the final quarter of 2017 Mielke expects oil prices to fall by more than 15 percent by 2018. That said he noted that cruel prices prices being bogged down are yet to unfold after Ramadhan when production begins to pick up. The expected decline at the.

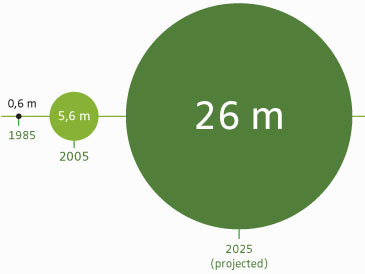

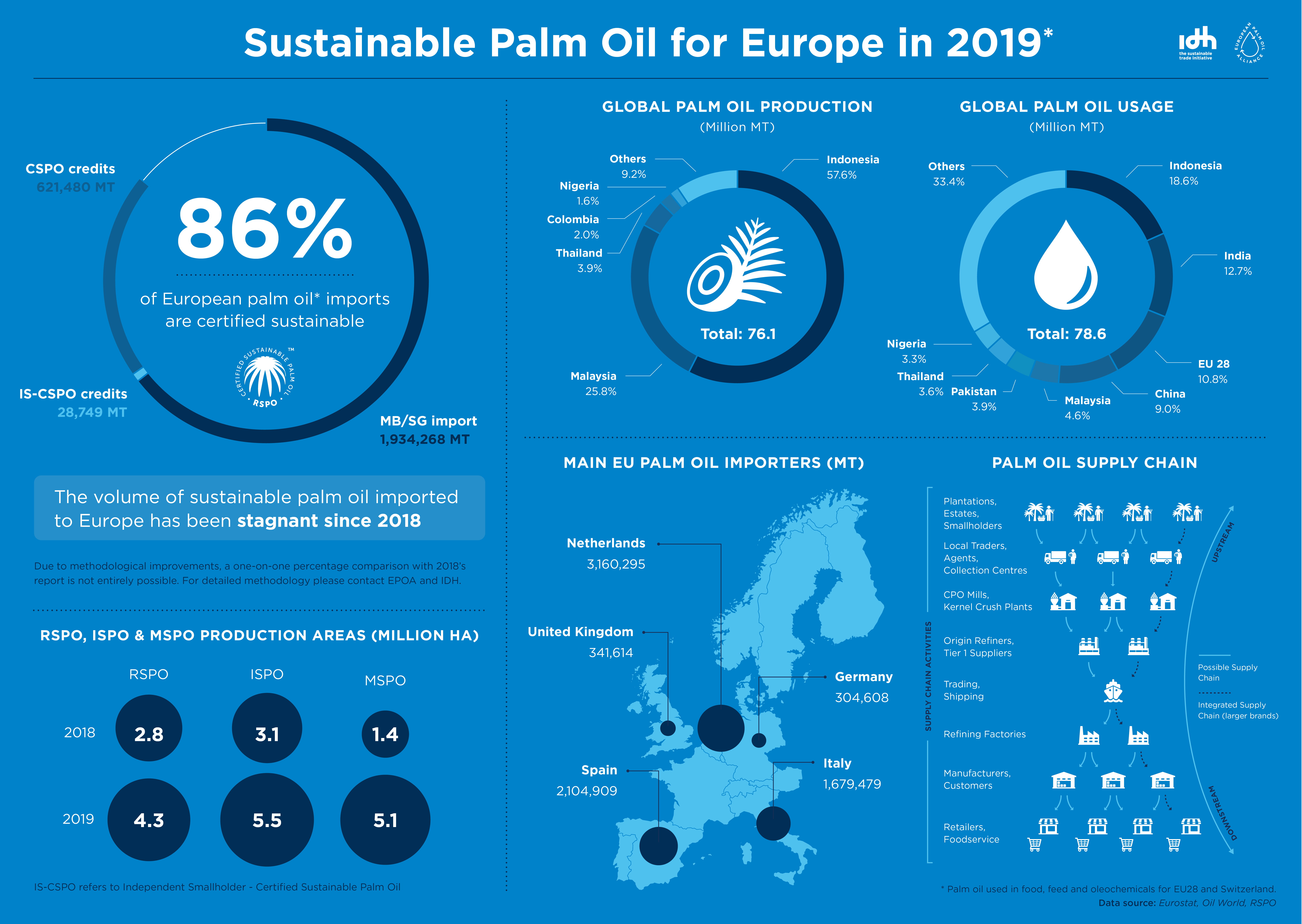

Malaysia is one of the largest palm oil producers in the world making it an important metric to look at when studying the Malaysian economy. 4 These are also countries that are expecting continued population growth a key. Three leading analysts of the palm oil industry Thomas Mielke James Fry and Dorab Mistry have a rare consensus on prices declining by year-end or early in 2018.

- A A. A dramatic fall in palm oil prices may provide an opportunity for plantation giants to add to their holdings reports Reuters. Key reason behind this decline is increased CPO output in Indonesia and Malaysia the worlds two top palm oil producers that - together - account for around 85 percent of total global CPO production.

Benchmark palm oil prices fell to a six-week low earlier this week on concerns of rising output and weak demand. In these conditions the price outlook for palm oil is not favourable. Palm oil prices will continue to rise in the first half of 2021 as global supply squeezed by a La Nina weather pattern is set to remain tight the Council of Palm Oil Producing Countries CPOPC said on Tuesday.

The government is accused of just waiting for things to happen rather than plotting new strategies to benefit smallholders. Malaysia Palm Oil Price is at a current level of 134807 up from 131025 last month and up from 91781 one year ago. Malaysia Palm Oil Prices are measured as the oil price in US Dollars per metric ton.

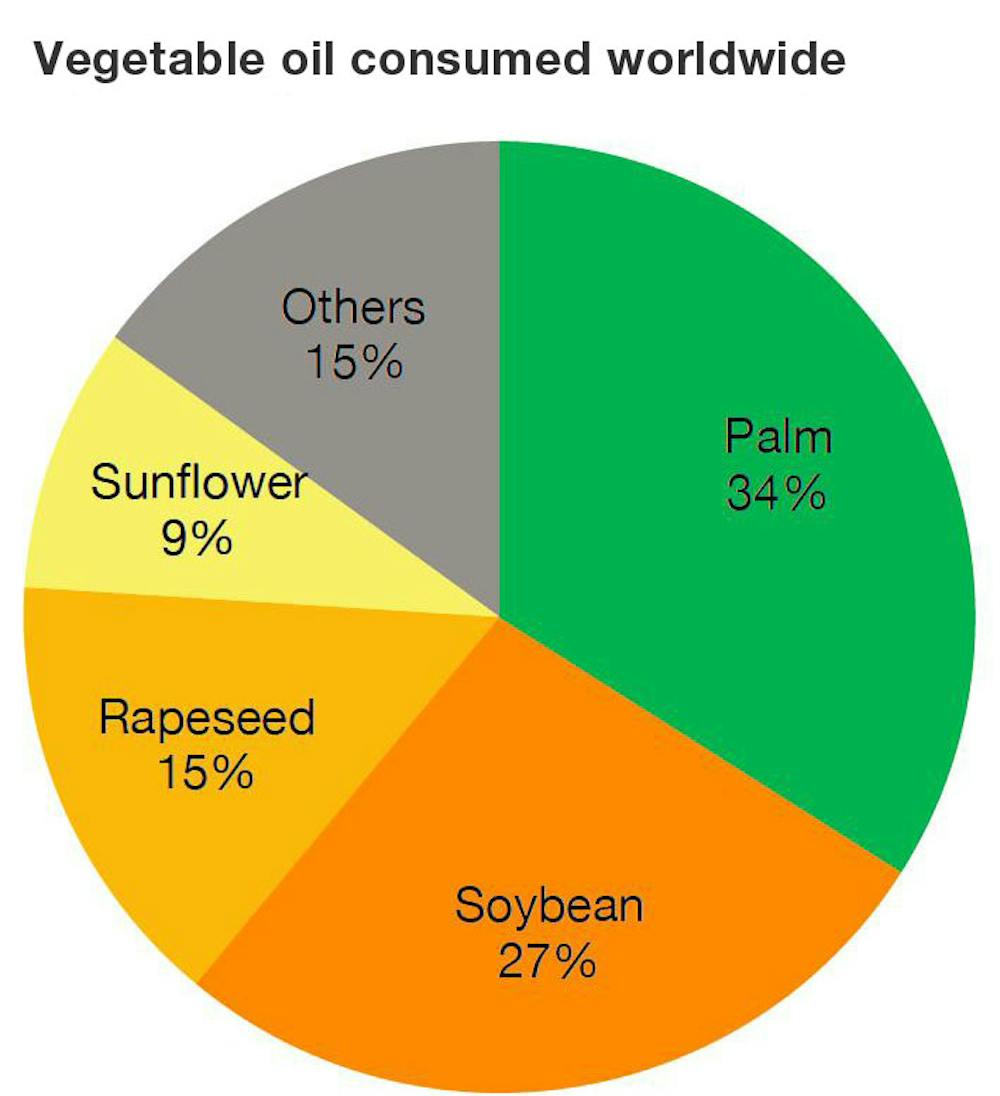

SINGAPORE Nov 23. This channel however has been muted as major oil producers have faced pressures to increase spending and as consumer countries continue to repair balance sheets. The rally in sunflower oil due to lower crop harvest has also made soy oil and palm oil attractive to price-sensitive buyers.

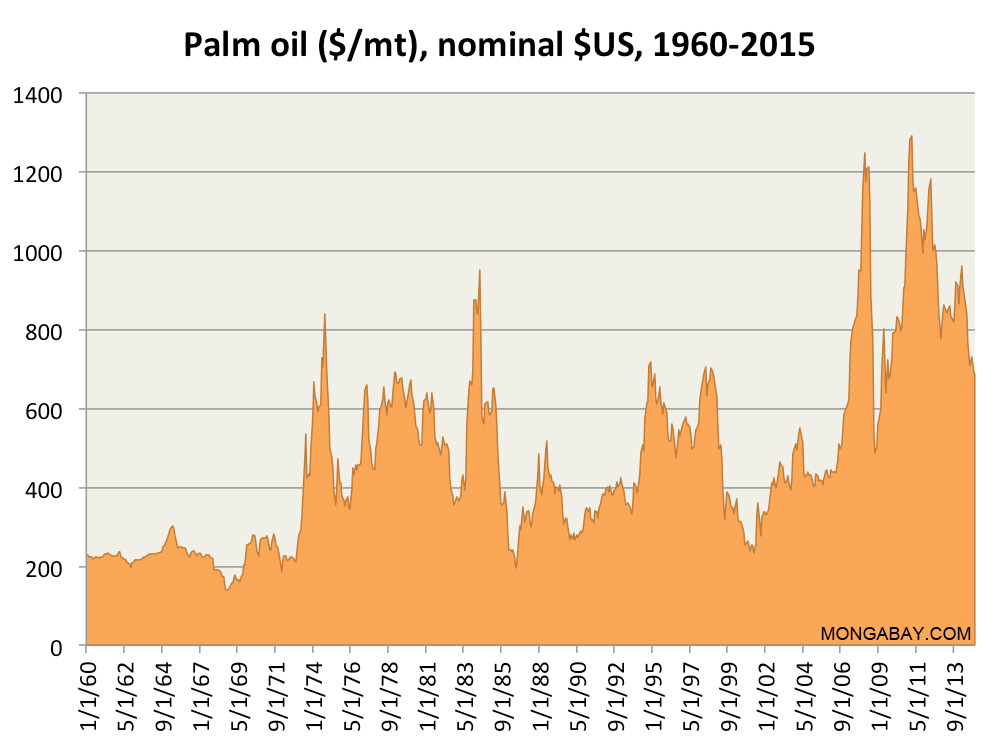

Malaysian palm oil futures fell from a peak of 1250 per tonne in February 2011 to 484 per tonne in August 2015. A second reason is that normally a supply-driven oil price decline raises world demand by transferring resources from high-saving oil producers to consumers with a higher propensity to spend. Understand the crude palm oil price behavior and its affecting factors.

Disruptions from persistent heavy rainfall in. During periods of dry spells or heavy rainfall resulting in flooding palm oil production would be affected and subsequently prices as well. November 10 2021 1508 pm 08.

Govt silence on palm oil price drop causing jitters. Palm oils use as biofuel has pulled down its price alongside oil whilst bumper crops of sunflower oil in Ukraine and Russia and soybeans in the US have driven prices even lower in the last few months. Palm oil prices have tumbled nearly 70 percent since reaching a high.

This was the biggest drop since prices fell 103 on Oct. Heavy rainfall during the second half of 2020 and improved fertilization techniques are expected to boost palm fruit yields leading to a recovery from. Palm oil demand has been rebounding since April 2021 which is causing high vegetable oil prices that is contributing to food price inflation in.

This is because major consumption of palm oil is in the commercial sector in food or other products demands of which have crashed substantially due to lockdown. It is because of the virus that all commodities are down a Kuala Lumpur-based trader told Reuters. Fry said supply-side disruptions due to the coronavirus would be minor but.

Demand Asia regions such as China and India are the key importers for palm oil together accounting for a quarter of the global consumption. Malaysian palm oil futures fell below MYR 4800 per tonne hitting its lowest level since October 5th and moving further away from a recent record peak of MYR 5220 amid concerns that the Omicron coronavirus variant could further hit the global economic recovery as well as demand for global edible oils. Despite the recent surge in crude palm oil CPO prices Kuala Lumpur Kepong Bhd KLK group chief executive officer Tan Sri Lee Oi Hian said CPO prices are cyclical and depend on climate change.

Also prices of 5 litres keg and or a bottle went for N2100 and N400 respectively against N2500 and N500 sold previously. Malaysia benchmark crude palm oil prices this year have plunged nearly 25 while crude oil prices are down about 50. Palm oil prices rose to a nine-year high in January 2021 owing to decreased production in the worlds top producing countries Malaysia and Indonesia which contribute to 85 of world production.

Indonesias palm oil exports and production in 2021 are both likely to fall for a second straight year the vice chairman of the countrys palm oil association GAPKI said on Tuesday. The price of palm oil might decrease for the next few months until the country completely recovers from Covid and lockdown. The crude palm oil CPO price weakened 385 percent to 2425 Malaysian ringgit per metric ton in the first quarter of 2018.

It was at 2151 ringgit 513 a tonne down 08 at midday break yesterday. Therefore understanding the theory of price is relevance in which it stated that price for any specifi c good or service is based on the relationship between supply and demand Friedman 1962. It indicated soy oil would lead the way.

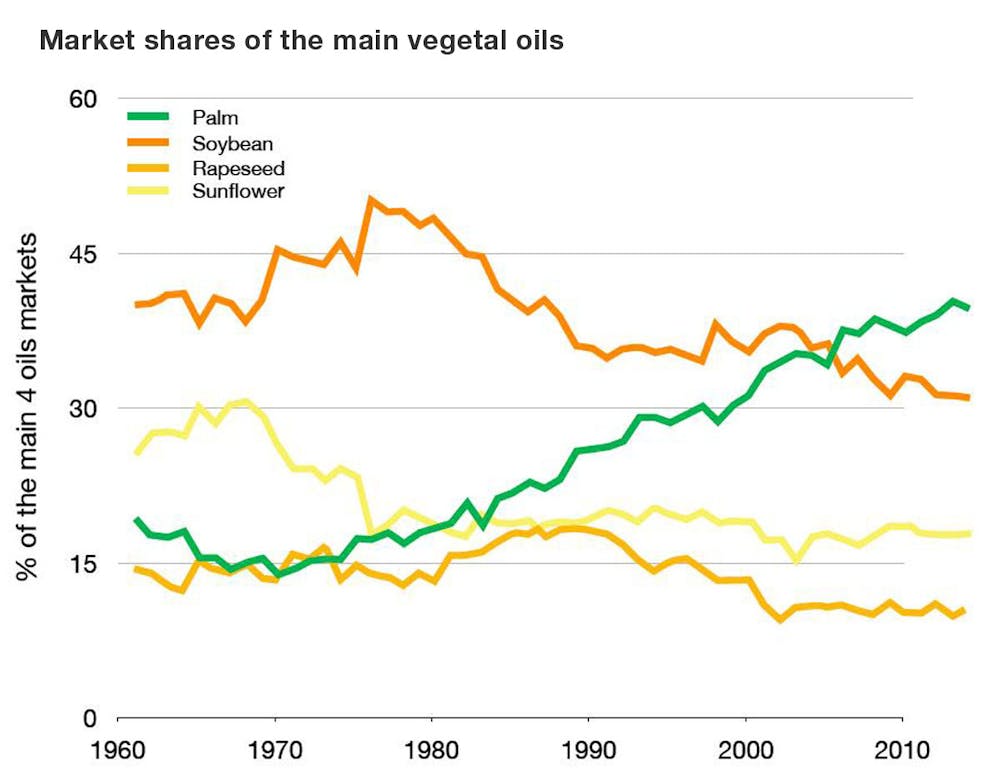

Oil World recently forecasted vegetable oil prices in 2021 should trade higher due to improved demand and a tighter supply of soft oils such as soybean and sunflower oils. KUALA LUMPUR Nov 10. Palm oil is affected by price movements in related oils as they compete for a share in the global vegetable oils market.

The plummeting price of Sabahs main commodity palm oil has made government leaders vulnerable to criticism from the opposition for failing to address.

Declining Palm Oil Prices Good News And Bad News For Smallholders

Malaysian Palm Oil Sector Performance In 2020 And Market Opportunities Mpoc

Declining Palm Oil Prices Good News And Bad News For Smallholders

Despite Falling Palm Oil Price Premium For Sustainable Product Rises

Palm Oil Sparks Eu Indonesia Trade War Gro Intelligence

The Geopolitics Of Palm Oil And Deforestation The Palm Scribe

The Geopolitics Of Palm Oil And Deforestation The Palm Scribe

Despite Falling Palm Oil Price Premium For Sustainable Product Rises

Palm Oil Industry 2020 Reflection 2021 Prospect Indonesian Palm Oil Association Gapki Ipoa

Palm Oil Market Analysis Output Recovery In 2022 To Cap Record Pricespalm Oil Market Analysis

Questions And Answers About Palm Oil Rainforest Rescue

Palm Oil Sparks Eu Indonesia Trade War Gro Intelligence

Despite Falling Palm Oil Price Premium For Sustainable Product Rises

Latest Data Shows 86 Of Palm Oil Imported To Europe Sustainable Idh The Sustainable Trade Initiative

Production Starts Rising Stock Recovering Indonesian Palm Oil Association Gapki Ipoa

The Geopolitics Of Palm Oil And Deforestation The Palm Scribe

The Chain China S Palm Oil Imports Surge Amid Global Trade Shifts Potentially Challenging Zero Deforestation Commitments Chain Reaction Research Sustainability Risk Analysis