Commission Gst Hsn Code

Land sales on a feecommission basis or contract basis. Services provided for a feecommission or contract basis on wholesale trade.

Printing Hsn Sac In Your Invoice

SAC code 996211 Services provided for a fee or commission or on contract basis on retail trade.

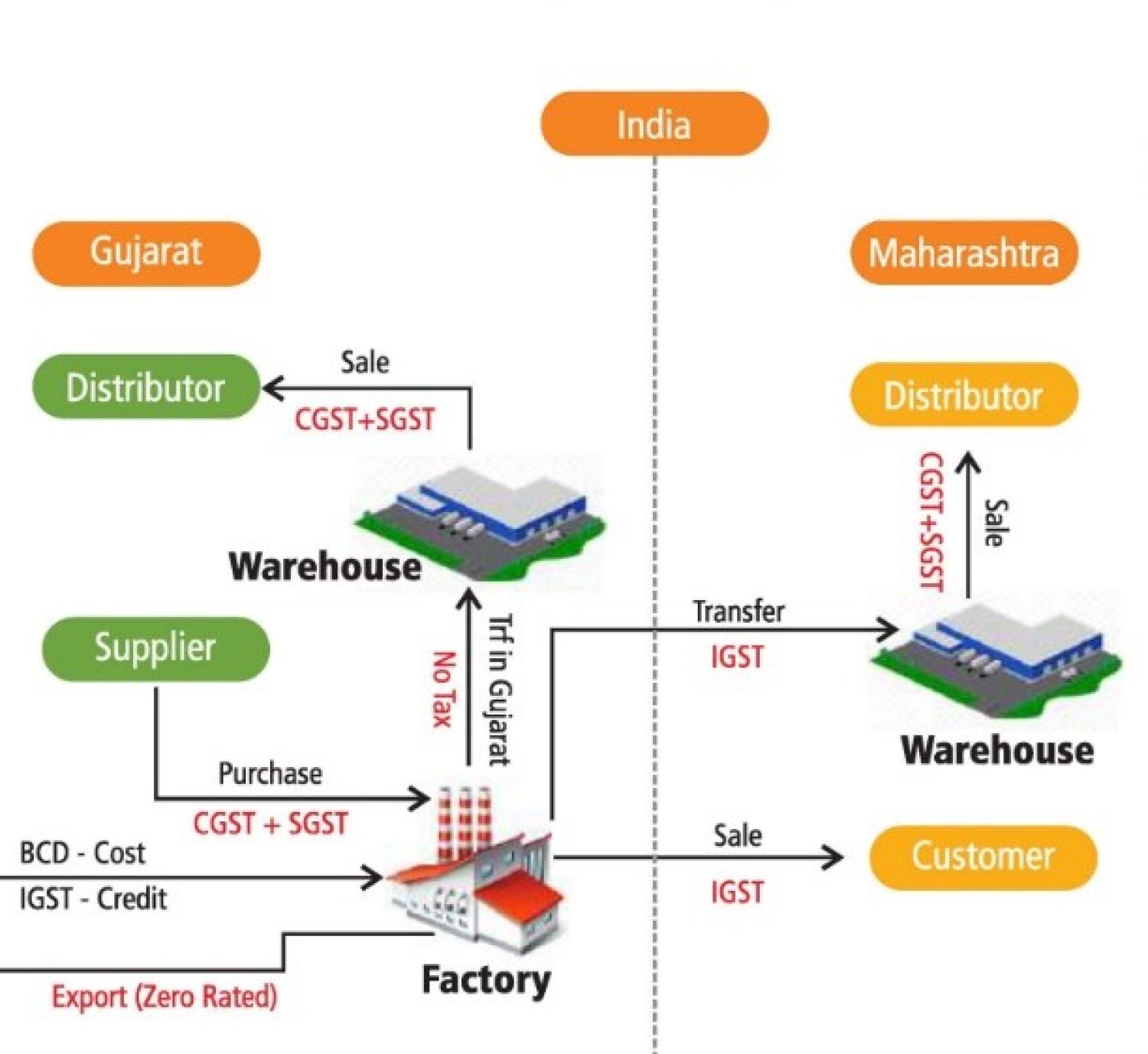

Commission gst hsn code. Real estate services on a feecommission basis or contract basis. 36610 18 GST tax Amount. Services of Clearing and Forwarding Agent CF do not fall under this head.

6 digit SAC code for Services provided for a feecommission or contract basis on wholesale trade. In above box you need to type discription of productservice or HS Code and a list of all products with codes and tax rates will be displayed. Services of commission agent in wholesale trade fall under GST HSN Code 99611.

GST Rates for Commission Agents and Brokers. Services Accounting Codes SAC Codes 997223 is used for the Land sales on a feecommission basis or contract basis under Goods and Service Tax classification. Show in your output supply in GSTR-1.

Get GST Rate and description for SAC Code - 996111. How could it be an intra-state transaction when the Service provider for receipt of commission is in India and the Principal foreign company to whom he is facilitating liasoning with the Indian customer importing the goods and the receipt is in foreign currency. The procedure to find HS Code with tax rate is very simple.

6 digit SAC code 996111 represents service. Find HSN number or Service tariff code for GST. HSN Code is important for GST Registration Migration and Enrolment as it is required to be compulsory given for all the different items a business manufactures trades or retails.

Services in wholesale trade. HSN Code is Harmonised System Nomenclature. HSN code is mandatory for all except with a turnover less than 15 Cr in a financial year and a taxpayer who have done GST Registration under the composition scheme.

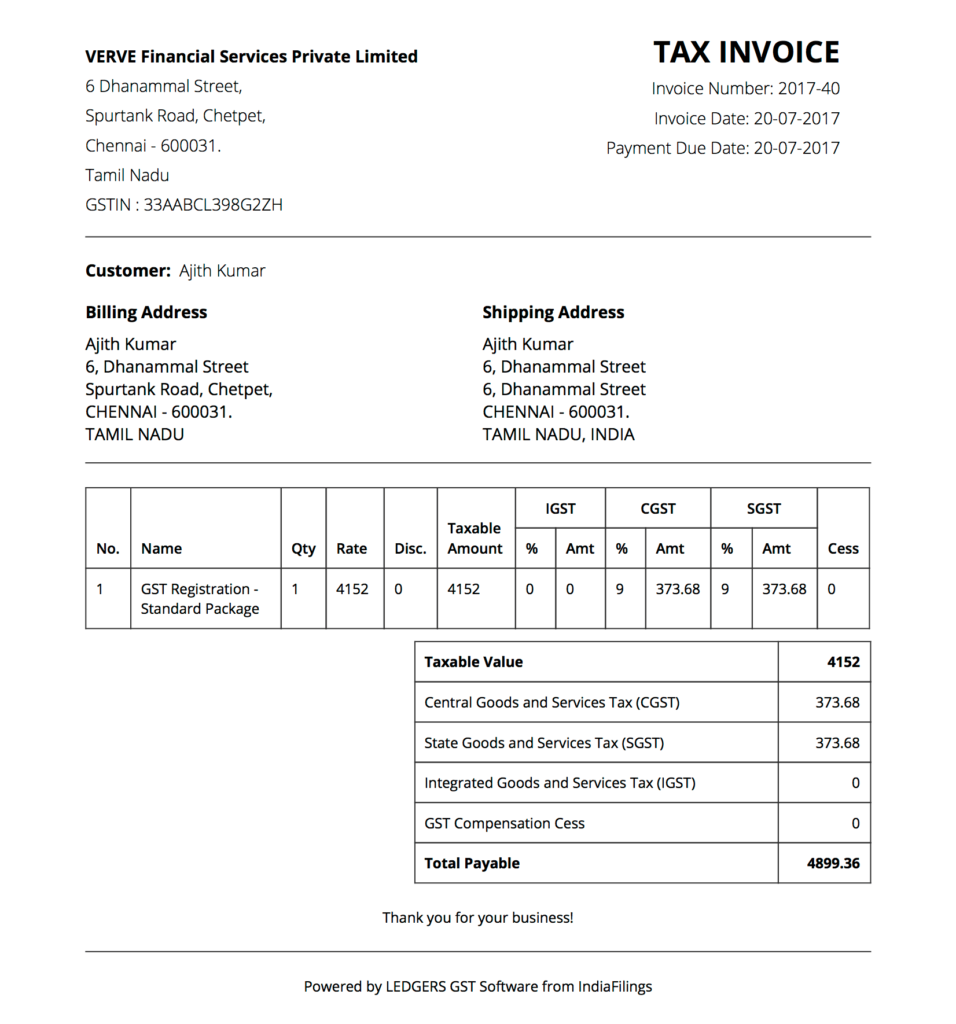

It is a mandatory requirement under GST to mention HSN SAC code in the GST invoice. In the given case no HSN Code is provided at 6 digit level. Search HS Code SAC code.

I was also looking to know the HSN Code of this service and the service it fits in 2. Property management services on a feecommission basis or contract basis. TDS on Commission Brokerage.

Taking an example of Cocoa powder to calculate the GST using HSN code. Any retailwholesale trade service. 57312018-GST Page 1 of 4 CBEC-201642018-GST Government of India Ministry of Finance Department of Revenue.

Hence GST is leviable on the amount of TDS. Services provided for a feecommission or contract basis on retail trade. Covid-19 accessory fund etc.

HSN is used for Goods commission is fall under Services so SAC code for commission is 9962. SAC code 996111 Services provided for a fee or commission or on contract basis on wholesale trade. What is HSN code for brokerage and commission service.

GST rate 18. Services of commission agents commodity brokers and auctioneers and all other traders who negotiate whole sale commercial transactions between buyers and sellers for a fee or commission Services of electronic whole sale agents and. 6 digit SAC code 997222 represents service.

The codes have been issued by Worlds Customs Organization WCO. Details are presented as it is adviced to proof check before taking any. What is HSN code for brokerage and commission service.

GST Rate and Service Code. 28 July 2017 Go through HSN code 996111 for Services provided for a feecommission or contract basis on wholesale trade OR 996211 Services provided for a feecommission or contract basis on retail trade OR 999799 Other services not elsewhere covered. Services of commission agent in retail trade fall under 99621.

GST Service Code 99621. In easy language it is the serial number of different items goods and services in Goods and Services Tax GST. GST Exemption list of goods and services.

6 digit SAC code for Building sales on a feecommission basis or contract basis. Cocoa Powder chocolate powder per Kg Rs1000. Click here to know GST rate on Goods and Services.

GST is applicable on commission. The rate of GST on commission is 18. GST Tax rates search from product name or SAcHSN.

Real estate appraisal services on a feecommission basis or contract basis. HSN code in GST list for a commission agent doing patient-centric activity like medical-camp. This group is for Services in wholesale trade.

They are used for the classification of commodities under various sections chapters headings and sub-headings that belong to alike nature. Therefore please note that the required 46 digits are the minimum number of digits to be mentioned in Invoice. Explanation-This service does not include sale or purchase of goods but includes.

Find GST HSN Codes with Tax Rates. Harmonized System of Nomenclature code HSN Code is used for classifying goods under GST. Here you can search HS Code of all products we have curated list of available HS code with GST website.

Service code 996211 Services provided for a feecommission or contract basis on retail trade Click here to go back GST service codes home page. Taxable amount is Rs20 3390 and GST amount is Rs. The rate of Goods Service Tax on commission is 18.

GST at 18 is applicable to all taxable value of supply provided by an agent including the salepurchase of advertising spacetime. It is treated as separate supply of services given by you to the seller of cement and you raise tax invoice amount Rs. TDS is part of your gross consideration ie.

Following are some of the services provided for a feecommission or on a contract basis. 24 included 18 GST amount. HSN code 18 05 00 00.

There is exemption on the amount of commission earned from regarding agriculture produce. This code is for Services provided for a feecommission or contract basis on wholesale trade. Services of commission agent in wholesale trade fall under 99611.

Therefore HSN Code 291040 shall not be a valid HSN Code. SAC Code - 996111 is for Services provided for a feecommission or contract basis on wholesale trade.

Hsn Code For Sales Commission In Gst 12 2021

Gst Hsn Code Hsn Code List Gst Rate Finder Paisabazaar

What Is Hsn Code And Sac Code In Gst With Complete List

Hsn Sac Codes Along With Gst Rate Hsn Classification Goods And Services Tax Rajput Jain Associates

Mandatory Hsn Sac Codes In Gst Invoices From 01 04 2021

Agents Under Gst Finance Instagram Income Tax

Pin By Rajesh Doye On Gst India Goods And Services Tax Goods And Service Tax Goods And Services Indirect Tax

Gst Rates For Goods And Services With Hsn Company Suggestion

Hsn Code List Gst Rate Finder What Is An Hsn Code For Gst

Mandatory Hsn Sac Codes In Gst Invoices From 01 04 2021

List Of Goods Exempted Under Gst In India With Hsn Code

Travel Backpack List August 2019 Travelling Light 7kg 15lbs Backpack Tour Packing List With Laptop Camera And Backpack List Gopro Backpack Packing List

Sac Codes Gst Rates For Services In India Indiafilings

Hsn Code Sac Mandatory On Invoices As Per Revised Requirement From 1st April For Gst Taxpayer With Turnover Of More Than Rs 5 Cr Cbic

Hsn Code On Invoice Requirement Under Gst Indiafilings

Get Eztax In E Way Billing App On Google Play Android Filing Taxes App File Income Tax

Understanding Hsn Codes Sac Under Gst 5 Questions Answered

Hsn Code For Sales Commission In Gst 12 2021

Mandatory Hsn Sac Codes In Gst Invoices From 01 04 2021